Of course, unmet invoices must eventually be taken care of by the company, but the company is free to spend that cash in the meantime for other needs. Hence, accounts payable functions like financing provided by the supplier with no interest owed, in contrast to other forms of debt securities. A/P Days counts the average number of days it takes for a company to fulfill an invoice from suppliers or vendors for orders placed using credit.

- The rates with which a firm pays its debts may reveal its financial health.

- It had an opening accounts payable balance of $500,000 and a closing accounts payable balance of $650,000.

- Once the sample invoices are reviewed, each of them must be confirmed and verified.

- Moreover, features like real-time reporting and analytics allow finance teams to quickly adapt to changing business needs and make more informed decisions, enhancing their agility and responsiveness.

- Bear in mind, that industries operate differently, and therefore they’ll have different overall AP turnover ratios.

Ready to transform your AP?

For example, if your firm’s accounts payable increases as compared to the previous period, this means that your business is purchasing more goods on credit than cash. However, if your accounts payable reduce relative to the previous period, this implies that you are meeting your short-term obligations at a faster rate. You record expenses and revenues when they are incurred or earned, regardless of when cash is exchanged. This approach includes the use of Accounts Payable (AP) for tracking money owed for purchases made on credit.

What are the Best Practices to Know for Accounts Payables?

Find the cost of goods sold (COGS) for the period from the income statement. These amounts are often a result of purchasing on credit, a common business practice that allows companies to buy goods now and pay for them later. When AP is paid down and reduced, the cash balance of a company is also reduced a corresponding amount.

How to calculate accounts payable?

An increase in the accounts payable indicates an increase in the cash flow of your business. This is because when you purchase goods on credit from your suppliers, you do not pay in cash. Thus, an increase in accounts payable balance would signify that your business did not pay for all the expenses. Accounts payable (AP) refers to the obligations incurred by a company during its operations that remain due and must be paid in the short term. Typical payables items include supplier invoices, legal fees, contractor payments, and so on.

What is a Good A/P Days?

This means it helps you to minimize late payment costs, such as interest charges, penalties, etc. These examples show you how your Accounts Payables can inform your company’s overall financial management, affecting everything from cash flow to supplier relationships and operational efficiency. On the flip side, using cash accounting can make a business’s financials appear more volatile.

Business Credit Card

As outlined in the previous section, accounts payable are liabilities reported on the balance sheet. On the other hand, business expenses are reported as expenses on the income statement. Recording accounts payable as both a credit and debit enables businesses to accurately track the payments they owe while also maintaining detailed financial records. Matching expenses with the revenues they generate provides finance teams with a clearer view of their business’s financial health. Use the tips discussed above to conserve cash and maintain good relationships with your vendors.

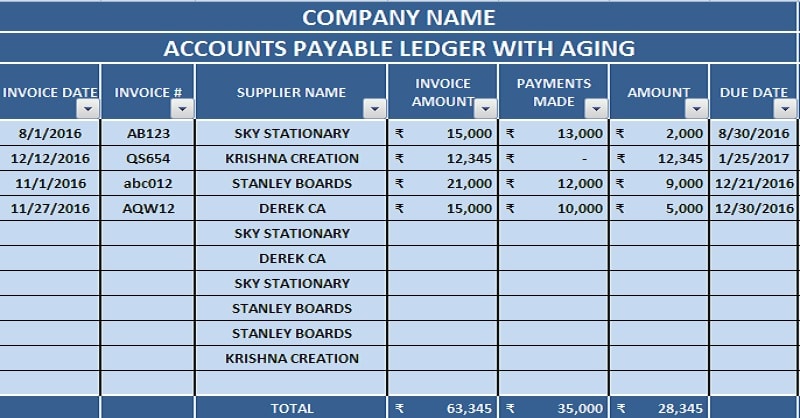

Investors can use the accounts payable turnover ratio to determine if a company has enough cash or revenue to meet its short-term obligations. Creditors can use the ratio to measure whether to extend a line of credit to the company. Accounts payable is a general ledger account that showcases the amount of money that you owe to your creditors/suppliers. If yo receive an invoice mentioning the payment terms from your supplier, it then gets recorded in your accounts payable ledger.

These are the amounts owed to suppliers or vendors from whom the company has purchased goods or services on credit. AP forecasting is the strategic process of estimating the future outflow related to how to prepare a master budget for your business in 2021 accounts payable within a specified period, usually a fiscal year. This practice is integral to managing a company’s short-term obligations—those debts and expenses due for payment within a year.

All you are required to do is record the transactions in the accounts payable subsidiary ledger and update the total balance on the balance sheet. Automating the accounts payable process reduces labor costs by digitizing manual processes like invoice processing and data capture. « Accounts Payable » refers to money a company owes its vendors for goods or services they purchased on credit. Teams record these liabilities, which represent short-term debt the company will pay over a specific period, in the general ledger. Both accounts payable and accounts receivable form an important part of trade credit. It is important for your business to receive trade credit from its suppliers in the form of accounts payable, as it helps finance your production process.

Two key components of this financial management are Accounts Payable (AP) and Accounts Receivable (AR), each playing a pivotal role but on opposite ends of the financial spectrum. So to get DPO, first you have to know what is your accounts payable turnover. If this number is high, that means it takes longer for the company to pay its suppliers. This delay can potentially harm the relationship with, or it can even lead to additional costs like penalties for overstepping due dates. We understand that as a CFO or financial controller, having efficient AP processes in place can help save your company’s money, as well as provide peace of mind and convenience when dealing with bills. This result means the company, on average, takes around 61 days to pay its suppliers.